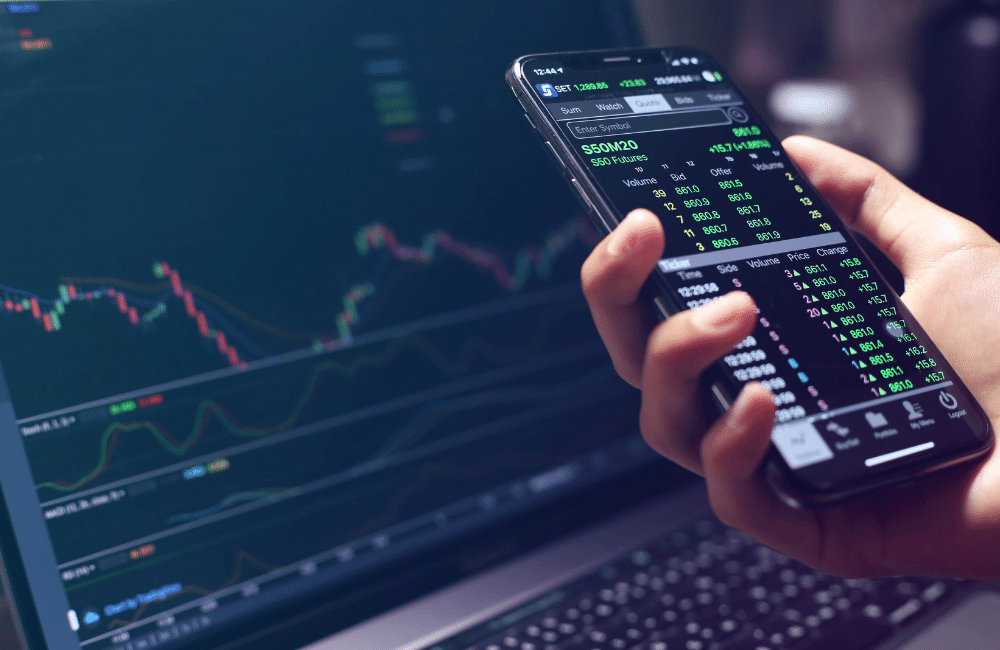

If you follow finance or business-related news, you might have heard that the stock market has rallied by x number of points or dipped by x points; after listening to it, you start scratching your head about what stock market points mean.

Though many of you will say that we understand what stock market points are and how they represent an increasing or decreasing trend in the stock market, however, it may be easier to understand the market’s direction; most people are completely clueless about its underlying phenomenon and its psychology.

So, if you want to start investing in the stock market and don’t have a freaking idea what stock market points are? Then, this is the best place for you, as we will cover all the details from basic to advanced about the stock market points and what they mean.

What do points mean in the stock market?

In the stock market, when a stock price moves in any direction, upwards or downwards, it is measured in points. For example, if a stock goes from $10 to $11, it is a one-point increase but equal to a change of 10% in the prices. Contrary to that, if a stock is currently at $50 and increases by one point to $51, then a single-point increase would represent a change of 2% in the share price.

This anomaly in the representation of stock market points can be confusing sometimes for newbies, so to make it easier, consider one point increase equivalent to an increase of one dollar in the share price. So, when you hear that a stock has gained or lost x number of points, it means that it has gained or lost the same x amount of dollars.

We must ensure we are not confusing stock points with the percentages or basis points (bps). When you hear that a stock has dropped by 10 points, that strictly denotes that it has reduced its value by $10. However, a change in points or basis points (bps) has a completely different meaning when we talk about stock indices like Dow Jones or S&P 500, bond prices, or currencies, as one basis point represents 1/100th of a percent. Thus, if someone says that S&P 500 has increased by 100 points, it is up by 1%.

Let us take a real example, taking Meta and HP into our test case scenario. Meta currently trades at $200, so a ten-point reduction in its stock will represent a decline of 5% in the share price. Though HP, trading at $30, faces a decline of 10 points, it would translate to a reduction of 33.33% of the share price.

Points and Market Indexes

Points represent moves in an individual stock and are referred to as short-term changes in the equity market index, i.e., The Dow Jones Industrial Average has gained 100 points today, or S&P 500 has shed 50 points. Because these indexes have thousands of companies listed in their index worth billions of dollars, and the changes in the index points represent a combined change by all those companies, thus it indicates a change in the combined value of all the companies listed in that index.

Points still represent dollars in the indexes, just like in individual stocks. Still, the major distinction is that the ratio in indexes is not 1:1. A point is just a whole number in the index value, as it combines different stocks with different weights.

Is percentage change better than points change?

Percentage changes are better than points change, as it better reflects what is happening on an apples-to-apples basis. Let’s assume there are two market indexes, one trading at 5,000 points and the other at 50,000 points. Now, if both shed 100 points on a particular day, this represents a 2% decrease in the first index, while the second one has reduced by only 0.2%, which is a much narrower decline than the first one. Hence, if someone says that a stock market is rising or falling, it is good to go for the percentage change rather than the points change.

Here you can learn How to Invest in Mutual Funds and Seize Your Financial Future!

Concluding

To summarize our discussion on the stock market points and what they mean, we now understand that stock points are used to describe share price gains or losses, for a short term, generally for a day or a week. Furthermore, we understood that we could represent stock market points with dollars on a 1:1 ratio for individual stocks. However, the same cannot be implied for the stock market indexes, such as Dow Jones Industrial Average or S&P 500, because they represent the combined value of thousands of stocks worth billions of dollars. Finally, we learned that though the point change and percentage change are important matrices in deducing the stock movement when looking at the overall market index, it is preferable to consider percentage change for a better representation.

FAQs – What are the points in the stock market?

Investing in stocks for beginners in 2023 starts with understanding the stock market basics and setting clear financial goals. Here’s a general guideline:

Educate Yourself: Learn about stock market fundamentals, various investment options, and risk tolerance.

Choose a Trading Platform: Select an online brokerage that offers user-friendly tools and minimal fees.

Start Small: Consider starting with low-cost index funds or ETFs that provide diversification.

Stay Informed: Monitor the market and your investments, but avoid reacting impulsively to short-term fluctuations.

Seek Professional Guidance if Needed: Consult a financial advisor for personalized investment strategies.

The best investment for 2023 depends on your goals, risk tolerance, and market conditions. Diversification is key, so consider a mix of asset classes such as stocks, bonds, real estate, and ETFs. Staying up-to-date with market trends and seeking professional advice can help you make informed decisions.

Predicting the exact movement of the stock market in 2023 is challenging, as it depends on various factors such as economic conditions, government policies, global events, and investor sentiment. Analysts may provide forecasts based on current data and trends, which are subject to change. It’s wise to stay informed by following reputable financial news sources and seeking professional insights tailored to your investment profile.

Determining if 2023 will be a good year for the stock market is speculative, as complex and often unpredictable factors influence market conditions. The best approach for investors is to focus on long-term strategies, diversification, and adherence to sound investment principles, rather than attempting to time the market based on yearly predictions.