If you are an investor, a business and economics news follower, or a business and economics student for that matter, you would probably have a little know-how about the stock market, interest rates and factors that affect their relationship.

But, for someone who is just starting out his investing career, or wants to understand the relationship between the interest rates and the stock market more deeply. Then, for those people, this is the right place for you as we will be discussing everything on how rising interest rates affect the stock market.

There can be both positive and negative implications of rising interest rates on the stock market. But, before understanding the exact relationship between the rising interest rates and the stock market, we should first understand the reasons behind increasing interest rates.

Reasons leading to rise in interest rates

Interest rate is the most important tool of the monetary policy that is managed by the central bank of a country. Central banks often adjust their targets in response to the economic activity in the country, like raising interest rates when the economy is overdoing and reducing the interest rates when the economy is sluggish.

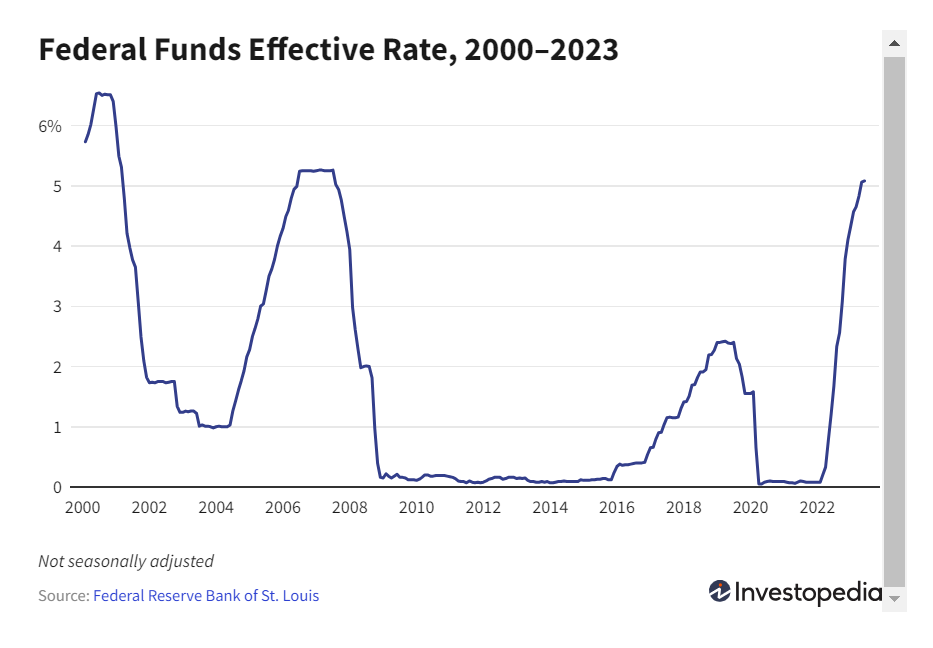

The Federal Reserve Board (FED) is the authority that is responsible for setting the annual targets for the interest rates in the United States. A target rate is the rate at which banks borrow and lend money to each other, also known as federal funds rate.

This change in the interest rate has a ripple effect across the economy and on the stock market. Though it usually takes a year for the interest rates to have an overall effect on the economy, the stock market can feel its heat almost instantly.

In addition to the federal funds rate, the federal reserve also determines the discount rate, which is the rate at which banks can borrow from the federal reserve itself. However, the discount rate is slightly higher than the federal reserve rate, to encourage banks to trade among each other.

To say the least, it is very important for the investors to understand the relationship between rising interest rates and the stock market. This will help them understand how a rise in interest rates can possibly affect their investments in the stock market and to make better and well-informed decisions.

Below, we will be diving deep on how rising interest rates affect the stock market.

What happens to the stock market when interest rates rise?

Generally speaking, interest rate and the stock market have an inverse relationship. This means that rising interest rates will negatively affect the stock market, as share prices fall and bonds will become more attractive.

However, there is a complete business investing theory behind this phenomenon. When the interest rates are on the rise, it increases the cost of borrowing which makes it difficult for the businesses to acquire funds from the financial institutions.

As funds become more expensive and difficult to acquire, this reduces the amount of money that is invested back in the company, and an unstable cash flow which puts a pressure on its share prices.

Actually, what happens is that the federal reserve regulates federal funds rate to control the inflation in the country. Increasing the federal funds rate means that you are trying to shrink the money supply available for purchasing things from the economy. This makes money more expensive to obtain.

Consequently, as it becomes difficult for the financial institutions to borrow money at lower rates, they tend to increase the rates they charge from their customers to make up for the rising costs. This, in turn impacts the consumers in their credit card and mortgage rates, especially when carrying a variable rate on them. This results in less funds available with the consumers to spend on purchasing different items, thus reducing the demand for unnecessary items.

As people now have limited amounts of money with them, and ever-rising expenses; people tend to reduce their consumption which reflects a decline in the sales and profitability of businesses. This is also one of the reasons that the share prices of companies fall when interest rates are on the rise. Both of these factors, increased cost of borrowing and low consumption, have a negative effect on the earnings and share price.

Investors response when interest rates are rising

If a company is seen not meeting its growth projections or becomes less profitable, either because of higher debt expenses or low sales, the expected future cash flows will decline, and will lower the company’s stock price.

If a similar trend is seen across the board in the stock market, then the whole market and stock indexes like Dow Jones Industrial Average or S&P 500 will fall back. Due to low return forecasts from the stock market investments, investors would likely lose hope on the stock market make the ownership of shares undesirable. This will lead to a massive selling spree in the stock market as people will try to withdraw their funds and move towards those asset classes which are expected to give better returns, like bonds.

However, rising interest rates do not affect the entire stock market negatively, there are a few sectors which do experience a positive impact of increase in interest rates. The most obvious one is the financial sector, which includes the banks, insurance companies, mortgage companies and brokerage houses. This is because of their business model, as the rising interest rates means that they can now charge more on lending to consumers which will result in an increase in their profits and will reflect back on their earnings and share prices.

The current scenario

If we look at the current scenario, we can hear all about the rising interest rates, a slowing economy and high inflation. Despite all of that, stock markets in the US have made substantial gains so far this year. The S&P 500 has increased more than 18% year-to-date.

However, the market index numbers have obscured the underlying trend, as majority of the positive returns have been generated by very few sectors, most associated with the tech companies.

The stock market recovery seen in 2023 was followed by a significant price correction that occurred in the stock market last year. The S&P 500, which is currently soaring high, was on the floor last year facing a major bearish trend, reflecting a decline of more than 20% from its peak, followed by other market indexes. Till date, the market has recovered much of its ground that it surrendered last year, but is still down from the peak it reached at the beginning of 2022.

The Federal reserve in its war against inflation, has continuously been increasing the interest rates from near-zero levels to the current rate of 5.25%. After the recent speech of Jerome Powell, chairman of the federal reserve, where he hinted about increasing the interest rates further in the future until they reach their target to sustainably bring down the inflation at 2%.

Another step taken by the Fed was to reduce its bond holdings, which had removed significant liquidity from the fixed market. This is inline with their objective of slowing the economic growth and reducing the inflation to a target rate of 2%, without going into a recession.

This has significantly changed the conditions for the stock market investors who were accustomed to a low-interest rate environment which had been going for an extended period till last year. Therefore, it’s important to understand how rising interest rates affect the stock market as a whole, and your portfolio in particular.

Putting your portfolio into perspective

As you assess your own situation, be it your risk profile, investment and holding capacity, or your investment horizon. One thing is clear that we can anticipate price volatility in the stock markets in the near future.

Assuming the current inflationary pressure eases in the coming days, and the economy ultimately recovers, the stock market will be a part of a balanced investment portfolio for the long-term investors. As seen with the US Bank, which has kept a neutral stance on investing in different asset classes as of now.

But, it’s important to understand the situation according to your circumstances and it is highly recommended to go to your wealth advisor, and seek advice regarding your comfort level with your current portfolio mix and how to make it more favorable in the upcoming days. Moreover, it’s important to discuss the appropriate response to an evolving stock market situation, that is consistent with your goals and time-horizon.