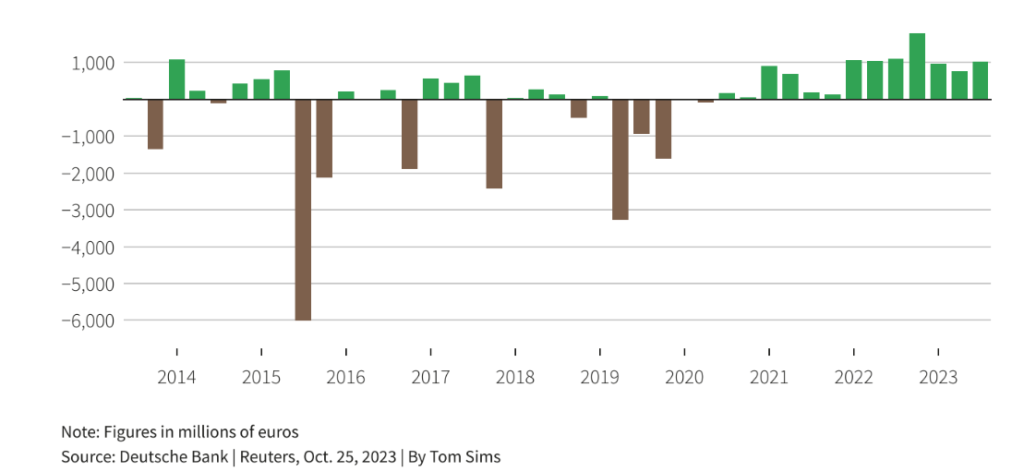

Deutsche Bank reported its net profit dropped by 8% in Q3; however, it remained higher than the expectations of most analysts, according to details posted on Wednesday. The net profit for Q3 was reported to be 1.031 billion euros ($1.06 billion), slightly higher than the expected earnings of 937 million euros.

The trend in profit earnings can be attributed to a slump in investment bank revenue, but a growth in retail and corporate divisions on the back of higher interest rates. The bank had been slightly more optimistic about its revenue estimates, forecasting an annual revenue of 29 billion euros ($30.73 billion), having upgraded the revenue forecast for the retail division.

The news is being taken as a positive development for the Bank resulting in a surge in share prices by 1.3% in the pre-market trade today. The earning figures are also seen as a hint of trend reversal in the investment banking industry, which has been struggling with sluggish trade activities throughout the year.

ALSO READ: Wall Street ended low as jobs data fueled up interest rate worries

A Remarkable Feat

The Q3 earning figures are seen as a significant feat for Deutsche Bank, marking the 13th consecutive profitable quarter, even though the profit dropped by 8% in Q3. On achieving this significant milestone, Deutsche Bank CEO Christian Sewing said that, “these results demonstrate strong and sustained business growth momentum combined with continued cost discipline.”

It should also be noted that the bank achieved this remarkable feat when its investment banking group is facing uncertain business prospects in the oncoming quarters. Moreover, its retail division has also drawn the regulator’s attention after numerous complaints were filed by the consumers on being logged out of their accounts.

DONT FORGET: SoftBank-backed Arm sets share prices at $51 ahead of the IPO

Going deep into data

The retail division remained the major revenue driver for Deutsche Bank in the third quarter, and analysts are estimating it to overtake the investment banking arm as the main revenue generator for the bank.

During the quarter, the revenue from investment banking dropped 4%, better than the expectation of 5% drop. However, the major contributors were the corporate and retail divisions, having increased revenues by 21% and 3%, respectively.

The bank’s revenue from fixed-income and forex trading fell by almost 12% in the third quarter from a year earlier due to low enthusiasm and low volatility in the markets. Furthermore, if viewed with the peer banks, Deutsche bank has been the worst performing bank in this sector.

Similar trading at Goldman Sachs slipped by nearly 6%, while JP Morgan’s was up by 1%. Barclays reported a 13% decline in revenues. However, the advisory services of Deutsche Bank contributed well in its revenue tripling it to 323 million euros from a year earlier.

($1 = 0.9433 euros)