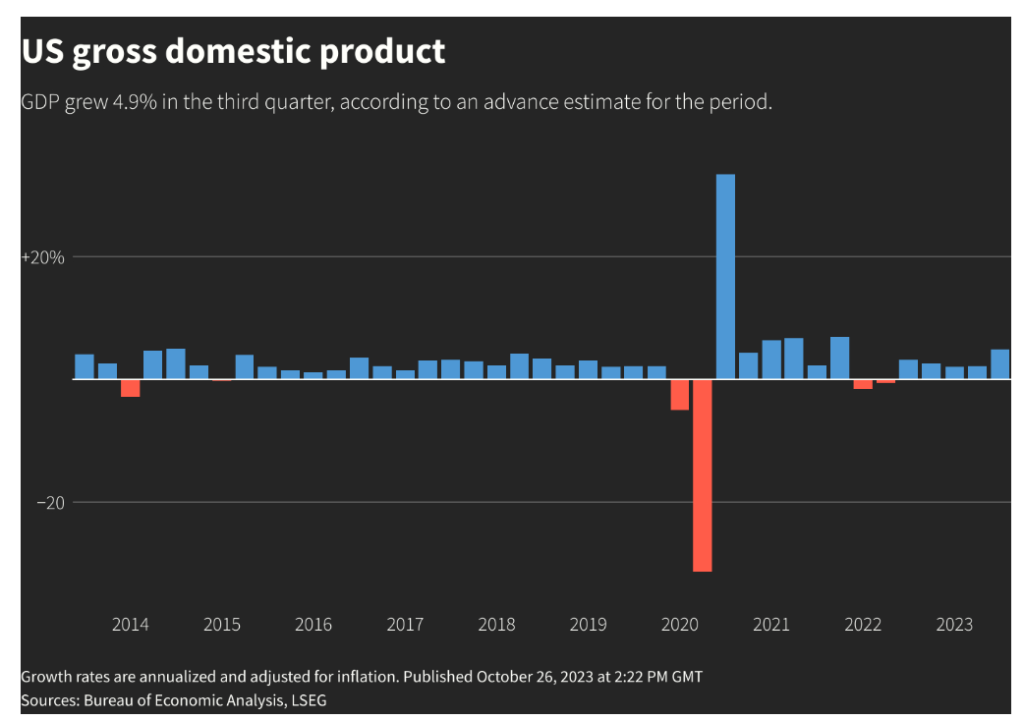

According to the figures, the US economy grew at a blockbuster pace in the third quarter, growing by 5% and defying all warnings of a recession. This blistering performance is partly associated with higher wage rates due to a tight labor market which bolstered the consumption rates.

Figures released by the Bureau of Economic Analysis of Commerce Department suggests that the GDP growth witnessed in Q3 is the fastest in two years, induced by a rebounding residential investment after it contracted for nine months.

Although government spending increased, the rate of investment in the business sector declined for the first time in two years. This could be attributed to a decline in the pace of construction of factories and a reduction in the outlays of computers.

ALSO READ: Oil prices dropped further on easing supply concerns

Underlying Economic Emotions

Despite the fact that this sort of GDP performance is unsustainable for a longer period, it still exhibited the economy’s endurance to aggressive interest rate increases by the Federal Reserve. Thus it is forecasted that the growth will slow down in the fourth quarter due to the resumption of student loans, regular strikes from United Auto workers, and the lagged effects of the interest rate hikes.

The report also hinted about a subsiding inflation in the third quarter, resulting that the US economy grew at a blockbuster pace. Economists, while revising their forecasts, now believe that the Fed can go for a soft landing of the economy, citing a continued worker’s productivity and moderated labor costs.

Brian Bethune, an economics professor at Boston College said, “we’ve seen for a period of time now a post pandemic induced negative bias about an imminent recession and persistent inflation.”

However, he was of the view that the “economy is surprisingly resilient, and has productivity-driven growth for two consecutive quarters in 2023, meaning the business cycle still looks very solid.”

DONT FORGET: Wall Street ended low as jobs data fueled up interest rate worries

Growing at a blockbuster pace

The US economy grew at a blockbuster pace of 4.9% in the third quarter, the fastest witnessed since the end of 2021. The actual figures have far exceeded the expectations of analysts forecasting a growth of 4.3%.

The economy grew at 2.1% in the previous quarter ended in June, and is operating far above the Fed’s acceptable levels for non-inflationary growth of 1.8% .

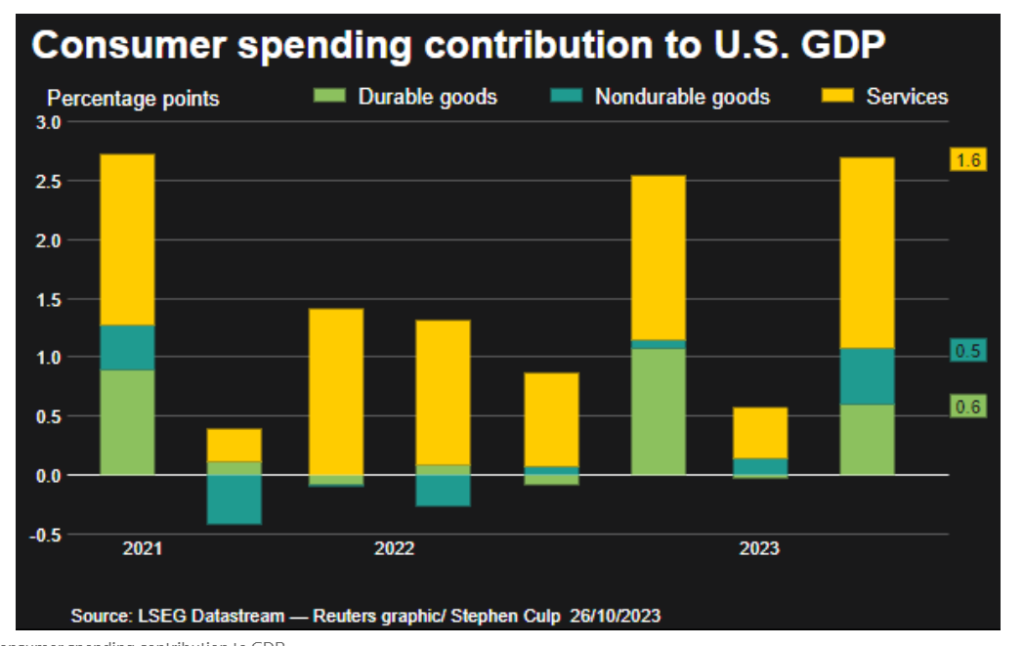

Further diving into the data, we can see that consumer spending which accounts for more than two-thirds of the US economic activity has increased by 4%, almost 5 times more than the previous quarter. The unexpected growth in consumer spending was equal in both the services and goods and added 2.69 % to the GDP.

The main reason behind this unreal consumer spending growth, is that despite slowing wage growth, it still has remained higher than the inflation, lifting the purchasing power. Though the increases in wages were offset by an increase in the personal tax; leading to consumers tapping into their savings to fund their spending, resulting in a decline in savings rate from 5.2% to 3.8%. –

MUST READ: UK economy grew unexpectedly; no more a post-Covid laggard

What lay ahead?

A declining savings rate coupled with the resumption of student loans, estimated to be $70 billion or 0.3% of the disposable income would dampen the consumption. Low income individuals are increasingly depending on debt to fund their purchases amid higher borrowing costs.

Moreover, economists have hinted that most of the savings accumulated during the COVID-19 is concentrated in a few high-income hands. Therefore, many economists are expecting a sharp slow down in the coming quarters as shared by United Parcel Service.

But many others are not too worried, saying that the spending was not only reliant on the debt, but more towards a strong labor market and generous government transfers during the pandemic.

Chris Low, chief economist at FHN Financial in New York said that, “it is too early to take slower growth for granted, especially after three quarters of consistently stronger-than-expected economic activity.”

He further added that, “any economist working on an update of their estimate of when pandemic savings will run out needs to tear it up and start thinking about what has allowed consumption to remain so strong. It is not borrowing.”