A hedge fund is an investment vehicle that pools capital from accredited individuals or institutional investors and employs various strategies to earn active returns, or alpha, for its investors. Hedge funds are known for their diverse strategies, including leveraging, short-selling, derivatives, and other sophisticated investment tactics. Unlike mutual funds, hedge funds are not as heavily regulated, allowing them more flexibility in their investment approaches.

Key Characteristics of Hedge Funds

1. Accredited Investors

Hedge funds typically require investors to be accredited, meaning they must meet certain income and net worth criteria. This exclusivity ensures that the investors have the financial resilience to handle the higher risk associated with hedge fund strategies.

2. Diverse Strategies

Hedge funds use a wide range of strategies to generate returns. These can include long/short equity, market neutral, arbitrage, macro, and event-driven strategies. Each strategy aims to capitalize on different market conditions and investment opportunities.

3. Leverage

One distinguishing feature of hedge funds is their ability to use leverage. Leverage involves borrowing money to increase the potential return on investment. While this can amplify gains, it also increases the risk of significant losses.

4. Performance Fees

Hedge funds typically charge a performance fee, commonly known as the “two and twenty” model: a 2% management fee and a 20% performance fee on profits. This fee structure incentivizes fund managers to maximize returns for their investors.

5. Limited Liquidity

Investing in hedge funds usually involves limited liquidity. Investors often have to commit their capital for a certain period and can only withdraw their money during specific windows. This illiquidity allows hedge fund managers to take a long-term approach in their investment strategies.

Benefits of Investing in Hedge Funds

1. High Potential Returns

Due to their flexible investment strategies and use of leverage, hedge funds have the potential to deliver higher returns compared to traditional investment vehicles like mutual funds and ETFs.

2. Diversification

Hedge funds can provide diversification to an investor’s portfolio by incorporating asset classes and strategies that are not typically found in conventional investments. This diversification can help mitigate risk.

3. Hedge Against Market Volatility

Certain hedge fund strategies are designed to perform well during market downturns, providing a hedge against market volatility and protecting the investor’s capital during economic uncertainties.

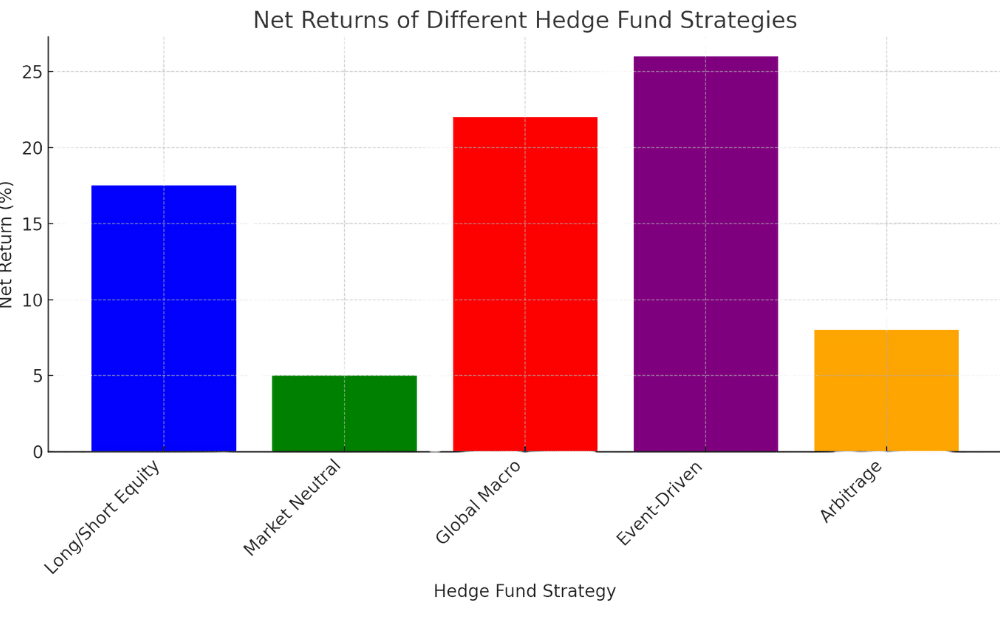

Comparative Net Returns of Popular Hedge Fund Strategies

Here is a table showing different hedge fund strategies with hypothetical returns:

| Strategy | Long Position Return (%) | Short Position Return (%) | Leverage Factor | Net Return (%) |

|---|---|---|---|---|

| Long/Short Equity | 15% | -5% | 1.5 | 17.5% |

| Market Neutral | 8% | -3% | 1.0 | 5.0% |

| Global Macro | 12% | -2% | 2.0 | 22.0% |

| Event-Driven | 20% | -10% | 1.8 | 26.0% |

| Arbitrage | 10% | -4% | 1.2 | 8.0% |

Explanation

- Long Position Return (%): The percentage return on investments where the hedge fund expects the asset to increase in value.

- Short Position Return (%): The percentage return on investments where the hedge fund expects the asset to decrease in value.

- Leverage Factor: The multiplier applied to the fund’s capital, increasing both potential returns and risk.

- Net Return (%): The overall return after considering long, short positions, and leverage.

Risks Associated with Hedge Funds

1. High Risk

The same factors that contribute to the high potential returns of hedge funds also make them risky investments. The use of leverage, complex strategies, and less regulation can lead to substantial losses.

2. Limited Transparency

Hedge funds are not required to disclose their holdings or strategies as frequently as mutual funds. This lack of transparency can make it difficult for investors to fully understand the risks involved.

3. High Fees

The performance fees associated with hedge funds can significantly reduce net returns, especially during periods of mediocre performance. The “two and twenty” fee structure is one of the highest in the investment industry.

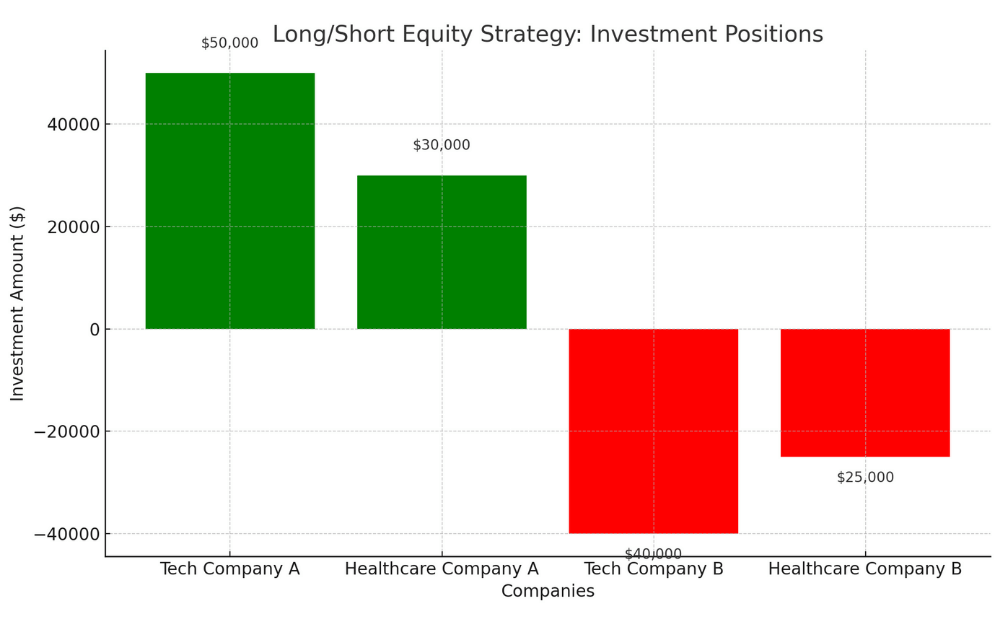

Example of a Hedge Fund Strategy: Long/Short Equity

In a long/short equity strategy, the hedge fund manager buys stocks they expect to increase in value (long positions) and sells stocks they expect to decrease in value (short positions). For example, if a hedge fund manager believes that Technology Company A’s stock will rise and Technology Company B’s stock will fall, they may take a long position in Company A and a short position in Company B. This strategy aims to capitalize on the price difference between the two stocks.

Graphical Representation of Long/Short Equity Strategy

Here’s a graph illustrating an example of a long/short equity strategy used by hedge funds. In this example, the hedge fund manager has taken long positions in Tech Company A and Healthcare Company A, and short positions in Tech Company B and Healthcare Company B. The investment amounts are shown on the y-axis.

Explanation

- Long Positions: The hedge fund manager invests $50,000 in Tech Company A and $30,000 in Healthcare Company A, expecting their stock prices to rise.

- Short Positions: The hedge fund manager shorts $40,000 worth of Tech Company B and $25,000 worth of Healthcare Company B, expecting their stock prices to fall.

This strategy aims to capitalize on the price differences between the companies. The blue bars represent the long positions, while the red bars represent the short positions.

Final Thoughts!

Hedge funds are a sophisticated investment option for accredited investors seeking higher returns and willing to accept higher risks. Their diverse strategies and potential for high returns make them an attractive addition to a well-rounded investment portfolio. However, it’s crucial to understand the associated risks and fees before investing.

For more insights into various investment options and financial strategies, check out our Investment Tips page on Multisiasat.

By understanding the fundamental aspects of hedge funds, investors can make informed decisions and potentially enhance their investment portfolios. Always consult with a financial advisor to determine if hedge funds align with your investment goals and risk tolerance.

Explore More

FAQs – Hedge Fund

A hedge fund is an investment fund that pools money from multiple investors to invest in a variety of assets, such as stocks, bonds, commodities, or other securities. The goal is to maximize returns while managing risk, often through complex strategies.

No, not everyone can invest in a hedge fund. Hedge funds are typically available only to accredited investors, such as wealthy individuals, institutional investors, or those who meet specific financial criteria. This is because hedge funds involve higher risks and require a significant minimum investment.

The term “hedge fund” comes from the strategy of “hedging,” which means to reduce risk. Hedge funds often use strategies that aim to protect or “hedge” against market downturns while seeking high returns. Although not all hedge funds strictly hedge, the name has persisted.

Hedge funds and mutual funds are both investment vehicles, but they differ in several ways:

Access: Hedge funds are generally for accredited investors, while mutual funds are available to the general public.

Strategies: Hedge funds use a wide range of complex strategies, including leveraging and short selling, to maximize returns. Mutual funds typically invest in stocks, bonds, or other securities and are more regulated.

Fees: Hedge funds often charge higher fees, including a performance fee, while mutual funds usually have lower management fees.

Liquidity: Mutual funds are usually more liquid, meaning investors can easily buy or sell their shares. Hedge funds often have lock-up periods where investors cannot withdraw their money.