Welcome to the world of Maple Motors, vehicle aficionados! Today, we set out to find out the answer to the hot topic on everyone’s mind: Does Maple Motors finance? Prepare for an exciting trip as we delve into the intricacies of Maple Motors’ financing choices, revealing the keys behind their success. Buckle up and come along with us on this financial adventure!

A Glimpse into Maple Motors – A Tale of Automotive Excellence

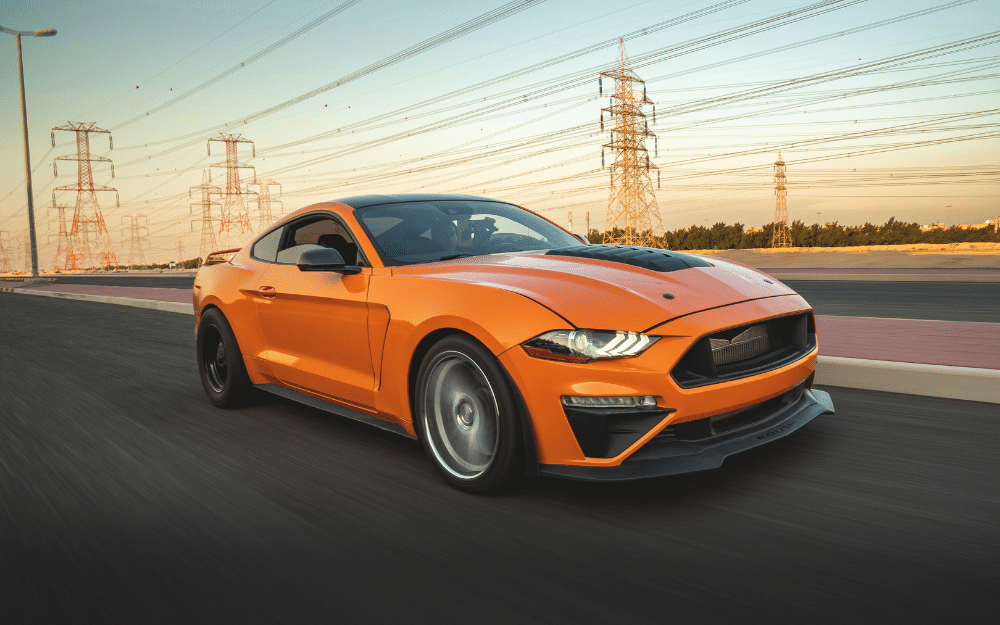

Before we go into finance, let’s take the time to savour Maple Motors’ miracles. Maple Motors has become synonymous with automotive excellence, thanks to its extensive history and excellent selection of high-quality automobiles. They provide diverse products, ranging from old classics to current marvels.

The Burning Question: Does Maple Motors Provide Financing?

Now, let’s get to the point: Does Maple Motors finance? Yes, it is a resounding YES! Maple Motors recognizes that owning a car is a serious commitment, and they work hard to make it affordable to everyone. They provide financing solutions to individuals who want to acquire a fantastic automobile from their inventory.

The Advantages of Financing with Maple Motors

There are several advantages to financing your vehicle purchase via Maple Motors. For starters, it offers a quick and streamlined method to get the necessary finances without dealing with different lenders. Furthermore, Maple Motors’ financing choices are intended to match its clients’ specific demands with flexible terms, low interest rates, and manageable monthly payments.

The Financing Process: Revealing the Mysteries

Let’s look deeper at the financing procedure now that Maple Motors offers it. It all starts with choosing your desired automobile from their extensive inventory. Once you’ve decided on a vehicle, the expert team at Maple Motors will walk you through the financing process. They will collect the necessary information, assess your financial status, and work hard to acquire the best financing arrangements.

Exploring Financing Options: Discovering the Best Fit

Maple Motors recognizes that each customer’s financial position is distinct. As a result, they provide a variety of financing solutions to meet a variety of demands. Whether you need typical bank funding, in-house financing, or help receiving a loan from an external lender, they can help. They collaborate with reputed financial institutions to provide you with financing options.

The Road to Approval: Meeting the Requirements

There are a few prerequisites to meet to obtain finance from Maple Motors. Evidence of income, identity, and evidence of insurance are usually required. Specifics may differ based on the financing type selected. The courteous team at Maple Motors will lead you through the appropriate paperwork and assist you in completing the requirements for a smooth financing journey.

What should you choose and avoid when Financing with Maple Motors

When evaluating financing alternatives with Maple Motors, it is critical to proceed cautiously and make educated selections. To help you along the way, here are some dos and don’ts to remember, as well as some crucial warnings:

Things to choose:

Investigate Maple Motors’ Financing Options: Take the time to investigate and comprehend the financing choices offered by Maple Motors. Learn about their in-house finance, collaborations with external lenders, and any special promotions or specials they may be doing. This knowledge will enable you to make your scenario’s most significant financial option.

Do Evaluate Your Budget and Financial Situation: Before beginning the financing procedure, assess your budget and financial capability. Take into account your income, spending, and other financial commitments. This self-evaluation will assist you in determining how much money you can easily dedicate to monthly payments without hurting your budget.

When faced with financing offers, compare the conditions and interest rates supplied by Maple Motors and other financial institutions. Look for competitive rates, advantageous terms, and flexibility that align with your financial objectives. Negotiate and ask questions to ensure you’re receiving the best possible bargain.

Things to avoid:

Don’t Ignore Your Credit Score: Your credit score is essential in obtaining advantageous loan arrangements. Avoid ignoring your credit history and, if required, take action to improve it. Pay your invoices on time, lower your debts, and correct any inaccuracies on your credit report. A strong credit score might result in lower interest rates and better lending terms.

Don’t Go Overboard: While financing a more expensive vehicle may be tempting, avoid going overboard. Check that your monthly payments are manageable and will not pressure your resources. Consider the vehicle’s purchase price, insurance, maintenance, and other associated costs.

Don’t Rush Through the Process: Financing a vehicle is an extensive choice, so take your time. Review your alternatives, review loan documentation, and understand the terms and circumstances. Rushing may result in missed facts or unfavorable loan terms.

Cautions:

Keep in Mind Your Loan Repayment Obligations: Understand your loan payback responsibilities when financing with Maple Motors. Failure to make regular payments can result in late fines, credit score loss, and car seizure. Before starting, ensure you are confident in your capacity to satisfy the loan commitments.

Be Aware of Interest Rates and Total Cost: While financing provides flexibility, it is critical to be aware of the loan’s interest rates and total cost. Higher interest rates might dramatically raise the total cost of the automobile. Evaluate the total cost over the loan term to ensure it fits within your budget and financial goals.

Consider Resale Value and Depreciation: Remember that automobiles, particularly those financed by Maple Motors, depreciate over time. When making finance selections, keep the vehicle’s resale value and depreciation rate in mind. This understanding can assist you in planning for the long-term financial repercussions of owning the automobile.

In a nutshell

Maple Motors is a light of excellence in the world of automotive magic. And the answer to our burning question is an emphatic YES – Maple Motors offers to finance! They make the desire to own a fantastic car a reality by offering a variety of financing choices, individual service, and a dedication to client satisfaction. So strap in, accept the financial magic, and set your sights on the road ahead with Maple Motors.

FAQs

Does Maple Motors offer financing options for all types of vehicles?

Yes, Maple Motors provides financing for various automobiles, including antique cars, luxury vehicles, trucks, etc. They know their clients’ unique demands and endeavor to provide financing alternatives for numerous car kinds.

What are the eligibility requirements for financing with Maple Motors?

To qualify for financing with Maple Motors, you must generally provide evidence of income, identity, and proof of insurance. Specific criteria may differ depending on the financing plan selected. Maple Motors’ helpful team can walk you through the eligibility procedure.

Can I apply for financing with Maple Motors if I have bad credit?

Yes, Maple Motors recognizes that everyone’s credit history is unique. They deal with various credit profiles, including individuals with less-than-perfect credit. While the terms and interest rates may vary, Maple Motors makes every effort to help clients obtain financing.