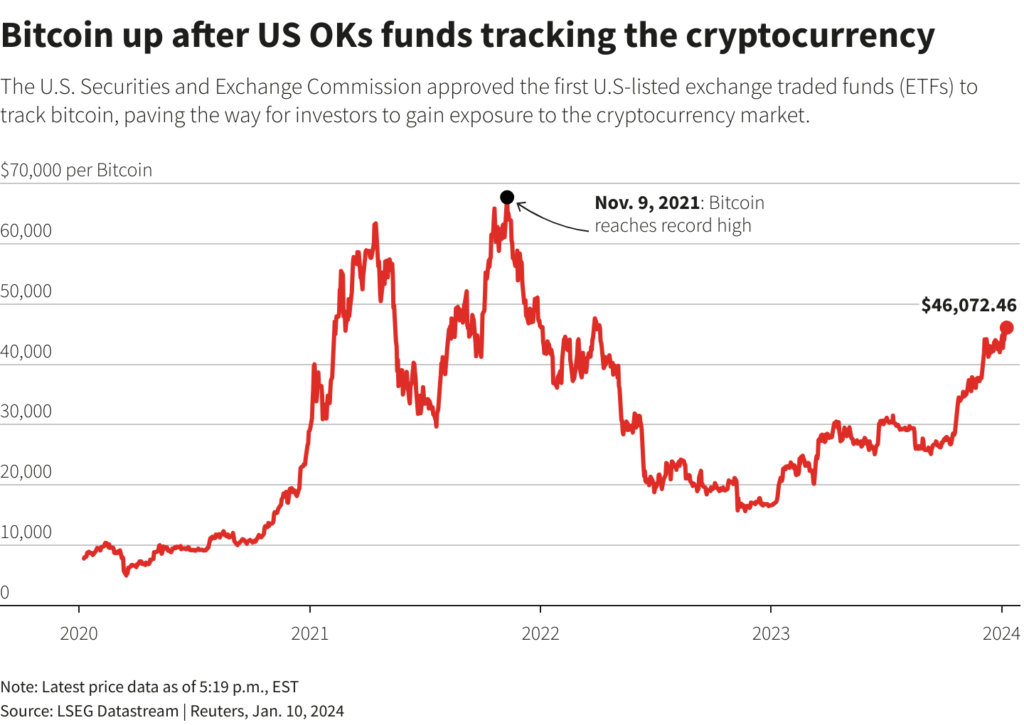

The listed Exchange Traded Funds (ETF) of bitcoin in the US market brings in $4.6 billion worth of shares trading on Thursday, on the first day of listing, as investors seek to jump on the landmark product approval by the US SEC.

The ETF approval marked a landmark moment for the cryptocurrencies as it will define the future of crypto assets – currently viewed as a highly risky asset. This approval will determine if cryptos would be able to gain a wider acceptance in the general investor’s eyes.

Among the eleven spot bitcoin ETFs that began their trading on Thursday included BlackRock’s iShares Bitcoin Trust (IBIT.O), ARK/21Shares Bitcoin ETF (ARKB.Z), and Grayscale Bitcoin Trust (GBTC.P), among many others.

This marked the beginning of a fierce competition among the major issuers of the ETF to gain market share, where BlackRock, GrayScale , and Fidelity dominated the market share on the first day of trading.

Todd Rosenbluth, a strategist at VettaFi said that, “trading volumes have been relatively strong for new ETF products, but this is a longer race than just a single day’s trading.”

ALSO READ: Indian state signs deals worth $4.4 billion with Apple suppliers, others

The ETF Approval Journey

Eleven issuers appealed to seek the approval of bitcoin ETFs including BlackRock, GrayScale, and Fidelity. However, the approval wasn’t an easy one. The green light from the US securities watchdog, the Securities and Exchange Commission (SEC) came late on Wednesday after a series of confusion and drama.

The drama unfolded after an unauthorized person posted on SEC’s official X account that bitcoin ETFs have been granted approval, which was immediately denied by the regulator and even issued a statement to investigate the matter.

However, the regulator itself in a surprising move announced later on the day that all eleven bitcoin ETFs had been granted approvals, marking an unprecedented instance.

The approval finally came after a decade-long tussle with the officials and fiat currency, as numerous analysts and executives called out cryptocurrencies as highly-risky investment class, and Vanguard, the largest mutual fund provider said it has no plans to make the spot batch of bitcoin ETF available for its customers.

Moreover, the SEC had earlier rejected all of the listing requests on investor security concerns. SEC Chair Gary Gensler in a statement on Wednesday said that “the approvals were not an endorsement of bitcoin, calling it a speculative and volatile asset.”

DONT FORGET: Tesla outshines BYD in China with real-time strategy

Crypto Stock Gain

The landmark spot bitcoin ETF launch in the US market brings in $4.6 billion, this helped lift the price of bitcoin up to its highest level since end of 2021 at $46,303, while other major coins including ether were also on the run.

Though cryptocurrency related stocks initially gained momentum on Thursday but ended the day in red with Marathon Digital (MARA.O) falling by 12.6%, while bitcoin miners riot platform dropping by 15.8% (RIOT.O).

The largest crypto exchange, the Coinbase (COIN.O) also went down by 6.7%, while ProShares Bitcoin was the only one to record a light gain of 0.44%.

Analysts are expecting that this event will pave the way for further innovative ETFs in the market, as Circle Internet Financial, the company behind Stablecoin announced that it has filed for the US IPO.