China’s GDP growth figures exceeds forecast as per the data released for Q3 on Wednesday. In addition, the industrial and consumption activities also exceeded the expectations, Suggesting that the recent measures undertaken to resume economic activity were indeed helpful.

This is a positive sign for the world’s second largest economy, as a rapidly weakening growth in the second quarter prompted the government to take immediate actions. The data released today is testament to the success of government support although a property crisis can still pose risks.

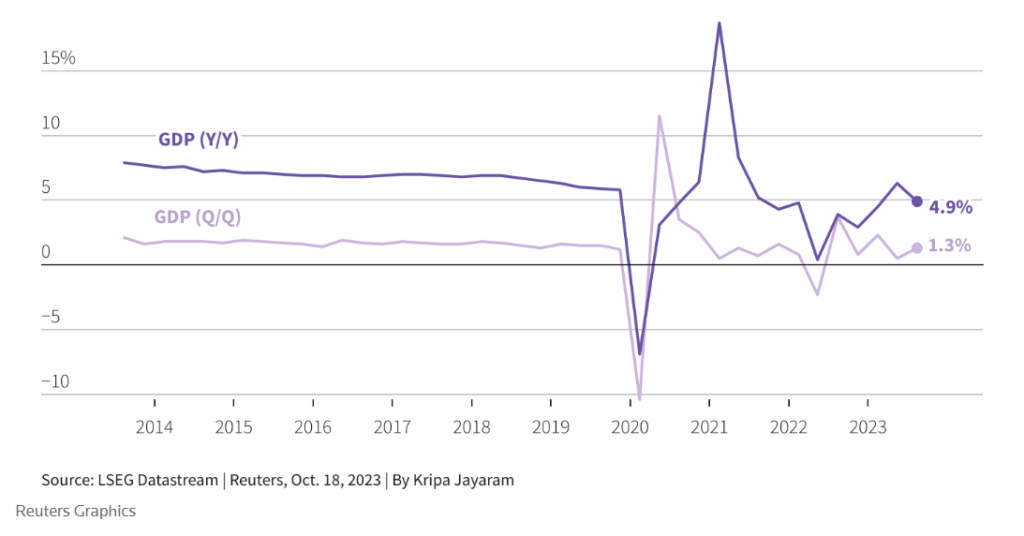

The China’s National Bureau of Statistics released Q3 economic data on Wednesday, showing a 4.9% GDP growth which exceeds the initial forecast of 4.4%. However, it still remained significantly slower than 6.3% expansion in the second quarter.

Moreover, on a quarter-to-quarter basis, the GDP grew by 1.3%, up from a revised target of 0.5% in the second quarter and a little above the forecast of 1%.

ALSO READ: UK economy grew unexpectedly; no more a post-Covid laggard

China’s stabilizing economic activity

China’s GDP growth exceeds the forecasts in the third quarter at 4.9%, suggesting that the recent recovery might have enough force to achieve the annual 5% growth rate target. A senior analyst at City Index, Matt Simpson said, “it seems that all of that stimulus is finally coming to take effect, with a broad beat from growth, retail sales, industrial production and unemployment.”

Economic activity has also shown signs of stabilization, with industrial production and retail sales meeting the median forecasts. According to the economists, the government is walking on tight rope trying to restore equilibrium, while navigating through a multitude of economic and social risks.

The domestic property crisis, low private sector confidence, high unemployment, and a slowdown in international growth are some of the risks policymakers need to be aware of. As mentioned earlier, Beijing had unveiled a series of measures to regain economic activity, however, the effect has largely been low due to the property sector default risks and a weak yuan.

DONT FORGET: New Zealand economy grew faster than expected amid services pick-up

On Track for the annual target

China’s economic recovery in the third quarter has increased the probability of achieving the government’s annual GDP growth target of 5%. Chief economist at an Asset management firm noted that “the improvement in Q3 economic data reduces the likelihood of the government launching stimulus in Q4, as the growth target of 5% is set to be achieved.”

He further indicated that “the government’s and market’s focus will then shift towards a positive growth outlook for the next year; however, it is still unknown what targets will be set.”

If we talk about the industrial sector’s performance, it grew more than expected at 4.5% in September, but the pace remained unchanged as in August. Moreover, retail sales also showed tremendous performance, exceeding the expectations and August pace with 5.5% growth in September.

MUST READ: China Evergrande Shares Plunged 25% following the arrest of wealth management staff

The Property Risks

Despite a better performance in the third quarter, a deepening property sector crisis accounting for nearly a quarter of economic output poses some serious risks to the economy. The latest data increased these concerns as the property investments in the first nine months had seen a massive decline of 9.1%, highlighting a weak private sector confidence.

This has hit some of the biggest property developers in China, like the Country Garden which has been unable to clear off $15 million debt as the grace period has passed, fueling fears of default.