Stock markets in Europe went into the red zone on the first trading day of October as latest PMI figures showed continued pressure on the manufacturing sector. The stoxx 600 was down by 1% after a cautious start to the session, chemicals dropped by 1.8% and utilities by 2.8%.

This comes amid a very rough September for the stock markets across the Eurozone. A slight positive start in the beginning of the trading suggests that investors are looking for some positive indication to kick off the last quarter, although the recent economic data won’t give them that confidence.

The latest round of purchasing managers index (PMI) data, released on Monday the economic data from across the globe. Following the Chinese PMI data revealed over the weekend that pointed towards a mixed manufacturing activity last month. The European market was no different as it showed a significant downturn in manufacturing output due to new orders falling by a record level.

ALSO READ: China’s exports fall in August amid weak global demand

Europe stock markets under the red line

Markets in Europe are under immense pressure after stock, bond, and forex markets fell last month all around the world, as investors expected elevated US interest rates for a longer period.

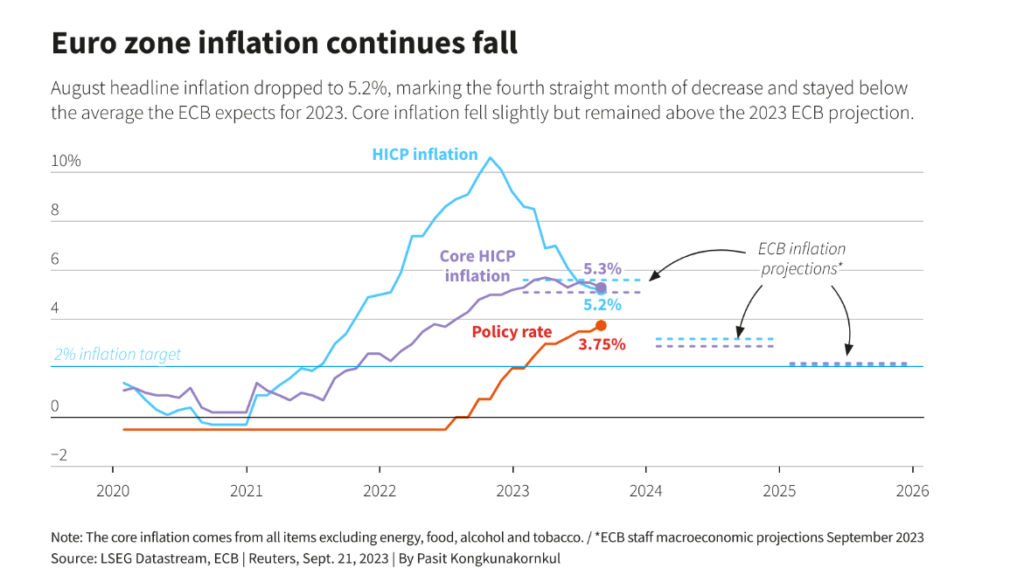

Meanwhile, the Eurozone is still struggling from the tremors of recession as indicated by a variety of economic indicators, dampening the positive news from the last week that inflation fell to its lowest in nearly two years.

According to the figures published last week, the inflation rates in the euro zone fell to its lowest point since October 2021. It plummeted to 4.3% in the outgoing month of September. The European central bank has also hiked interest rates to a record level last month, but the markets are predicting that it has already reached its peak.

DONT FORGET: Inflation rose 3.2% in July shows US CPI report, less than market expectations

How does the coming weeks look like for the Europe stock markets?

The PMI data from the EU is being closely watched after the preliminary report published last month suggested a mixed canvas of the region’s economic health. The PMI showed a slight rise from August’s 33 month low, yet still remained below the line that separated the boom-bust cycle.

An inflation indicator, preferred by the US federal reserve, rose by less than estimated in August, shrinking the market-based probabilities for rate hike in the future.

Elsewhere across the globe, Asia-Pacific markets traded under mixed pulse as the manufacturing data out of China climbed back into the expansion territory. However, the US stock market trickled down even after the US legislators came to an agreement that saved them from a government shutdown.

Regardless of the PMI data, markets might find at least some temporary cheer in a last minute funding bill that allowed the US government to continue its operations through November 17th, even if it could not save the US markets from trembling.